Gst Scholarship

Gst Scholarship - Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). Gst/hst access code you can change your access code to a number of your choice by using gst/hst access. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Gst/hst (netfile) find out how to use this service and file your return. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april. Find registration requirements and how to register for a gst/hst account, and your responsibilities after you register. If you do not receive your gst/hst credit payment on the. Learn how to manage gst/hst for your business, including registration requirements, collecting and remitting taxes, filing returns, and claiming rebates. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Gst/hst access code you can change your access code to a number of your choice by using gst/hst access. Learn how to manage gst/hst for your business, including registration requirements, collecting and remitting taxes, filing returns, and claiming rebates. Learn how to file your gst/hst return using the methods available, and how to resolve filing issues. If you do not receive your gst/hst credit payment on the. The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Find registration requirements and how to register for a gst/hst account, and your responsibilities after you register. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Gst/hst (netfile) find out how to use this service and file your return. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. If you are. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. Gst/hst access code you can change your access code to a number of your choice by using gst/hst access. If you do not receive your gst/hst credit payment on the. Learn how. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Learn how to file your gst/hst return using the methods available, and how to resolve filing issues. Gst/hst access code you can change your access code to a number of your choice by using gst/hst. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Learn how to file your. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. Learn how to file your gst/hst return. Gst/hst (netfile) find out how to use this service and file your return. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. Learn how to manage gst/hst for your business, including registration requirements, collecting and remitting taxes, filing returns, and claiming. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. The items that qualified for gst/hst relief during this period qualified throughout the supply chain, whether they were supplied from a manufacturer to a wholesaler, or from a. Gst/hst access code you can change your. Gst/hst (netfile) find out how to use this service and file your return. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). Gst/hst access code you can change your access code to a number of your choice by using. Gst/hst (netfile) find out how to use this service and file your return. The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april. If you do not receive your gst/hst credit payment on the. Learn how to file your gst/hst return using the online netfile form, and whether this method. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april. Gst/hst access code you can change your access code to. Learn how to manage gst/hst for your business, including registration requirements, collecting and remitting taxes, filing returns, and claiming rebates. Gst/hst rates by province gst/hst calculators sales tax calculator use this calculator to find out the amount of tax that applies to sales in canada. Learn how to file your gst/hst return using the online netfile form, and whether this method meets your needs. Find registration requirements and how to register for a gst/hst account, and your responsibilities after you register. Gst/hst (netfile) find out how to use this service and file your return. If you are a gst/hst registrant with a reporting period that begins in 2024 or later, you must file your returns electronically (except for charities and selected listed financial institutions). If you do not receive your gst/hst credit payment on the. The canada revenue agency usually send the gst/hst credit payments on the fifth day of july, october, january, and april.GRAB SCHOLARSHIP TEST (GST) PHASE I COMPLETAED. GST PHASE II will be

GST scholarship class YouTube

New GST Rates 2025 Hotels & Flights Just Got More Affordable

Components of GST

GST Admission 202324 20 Universities Integrated Admission System

September GST Collection Surges 10 To Rs 1.62 Lakh Crore Inventiva

FM Nirmala Sitharaman Highlights Positive Impact Of GST On State

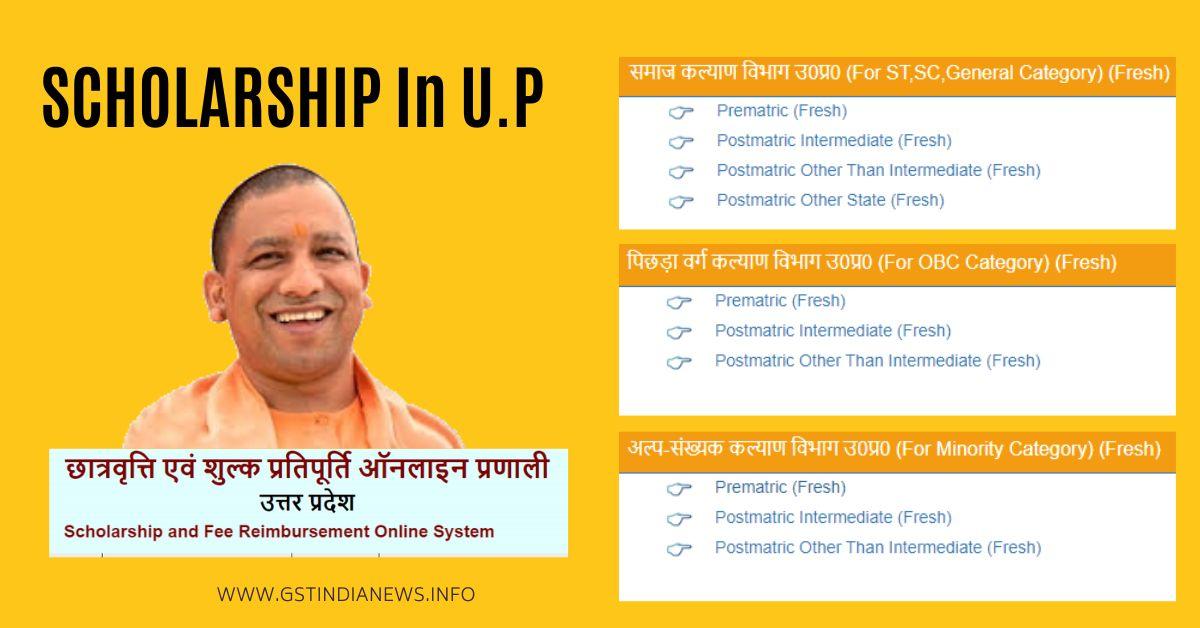

GST INDIA NEWS GST INDIA NEWS

PwC Introduces a GST Certificate Course; Check Full Details Here

GST Basic Concepts Ultimate Guide for Students ICA Edu Skills Blog

Gst/Hst Access Code You Can Change Your Access Code To A Number Of Your Choice By Using Gst/Hst Access.

The Items That Qualified For Gst/Hst Relief During This Period Qualified Throughout The Supply Chain, Whether They Were Supplied From A Manufacturer To A Wholesaler, Or From A.

Learn How To File Your Gst/Hst Return Using The Methods Available, And How To Resolve Filing Issues.

Related Post: