Famu Full Ride Scholarships

Famu Full Ride Scholarships - 0845 010 9000 open 8.00 am to 8.00 pm. Is hmrc correct we cannot reclaim the vat based on the old eori number i wrote before on this issue so what happened my client imported goods from overseas using. A vat number checker is still useful as part of due diligence if selling to a new uk business, but yes, vies may not be as useful as it is currently. There are different methods of checking that a vat number is correct. We have a spanish office, which has been operating for the last few years with a vat number. Or do you need to ring up ? If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same vat number. I searched the hmrc vat section and nothing came up. For the uk you can ring the hmrc helpline (vat helpline: Finding effective date of vat registration new client, need registration date i am trying to authorise a client online for filing vat returns, and i need the date of first registration. There are different methods of checking that a vat number is correct. For the uk you can ring the hmrc helpline (vat helpline: Xi eori number format & checker is there one for new ni xi eori numbers? Finding effective date of vat registration new client, need registration date i am trying to authorise a client online for filing vat returns, and i need the date of first registration. I searched the hmrc vat section and nothing came up. I am creating a register of ec client vat registration numbers to document the verification of vat numbers via the ec website: Can you check online whether a vat number is valid ? In the past i've been able to amaze clients who have applied for a gb eori number but not received. Is hmrc correct we cannot reclaim the vat based on the old eori number i wrote before on this issue so what happened my client imported goods from overseas using. Or do you need to ring up ? 0845 010 9000 open 8.00 am to 8.00 pm. If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same vat number. I searched the hmrc vat section and nothing came up. This number appears invalid on the vies search. Just registered for uk vat and the vat number is. Will this have any tax/vat. There are different methods of checking that a vat number is correct. 0845 010 9000 open 8.00 am to 8.00 pm. Can you check online whether a vat number is valid ? A vat number checker is still useful as part of due diligence if selling to a new uk business, but yes, vies may. Or do you need to ring up ? This number appears invalid on the vies search. There are different methods of checking that a vat number is correct. Just registered for uk vat and the vat number is not showing as valid on vies, how do i get it on vies? Will this have any tax/vat. Or do you need to ring up ? A vat number checker is still useful as part of due diligence if selling to a new uk business, but yes, vies may not be as useful as it is currently. If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same. Can you check online whether a vat number is valid ? Xi eori number format & checker is there one for new ni xi eori numbers? I am creating a register of ec client vat registration numbers to document the verification of vat numbers via the ec website: In the past i've been able to amaze clients who have applied. If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same vat number. There are different methods of checking that a vat number is correct. Will this have any tax/vat. We have a spanish office, which has been operating for the last few years with a vat number. This number. Xi eori number format & checker is there one for new ni xi eori numbers? This number appears invalid on the vies search. 0845 010 9000 open 8.00 am to 8.00 pm. Can you check online whether a vat number is valid ? Finding effective date of vat registration new client, need registration date i am trying to authorise a. Just registered for uk vat and the vat number is not showing as valid on vies, how do i get it on vies? In the past i've been able to amaze clients who have applied for a gb eori number but not received. Is hmrc correct we cannot reclaim the vat based on the old eori number i wrote before. If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same vat number. Finding effective date of vat registration new client, need registration date i am trying to authorise a client online for filing vat returns, and i need the date of first registration. In the past i've been able. There are different methods of checking that a vat number is correct. A vat number checker is still useful as part of due diligence if selling to a new uk business, but yes, vies may not be as useful as it is currently. This number appears invalid on the vies search. 0845 010 9000 open 8.00 am to 8.00 pm.. Xi eori number format & checker is there one for new ni xi eori numbers? A vat number checker is still useful as part of due diligence if selling to a new uk business, but yes, vies may not be as useful as it is currently. Is hmrc correct we cannot reclaim the vat based on the old eori number i wrote before on this issue so what happened my client imported goods from overseas using. In the past i've been able to amaze clients who have applied for a gb eori number but not received. I searched the hmrc vat section and nothing came up. If subsidiary company s pay supplier invoice that is addressed to parent company p where both company vat registered under same vat number. 0845 010 9000 open 8.00 am to 8.00 pm. Can you check online whether a vat number is valid ? I am creating a register of ec client vat registration numbers to document the verification of vat numbers via the ec website: Just registered for uk vat and the vat number is not showing as valid on vies, how do i get it on vies? We have a spanish office, which has been operating for the last few years with a vat number. Finding effective date of vat registration new client, need registration date i am trying to authorise a client online for filing vat returns, and i need the date of first registration. There are different methods of checking that a vat number is correct.Full Ride Scholarships What They Are and How to Get Them

How Common Are FullRide Scholarships?

The FullRide Scholarship eBook Over 100 Scholarships Included

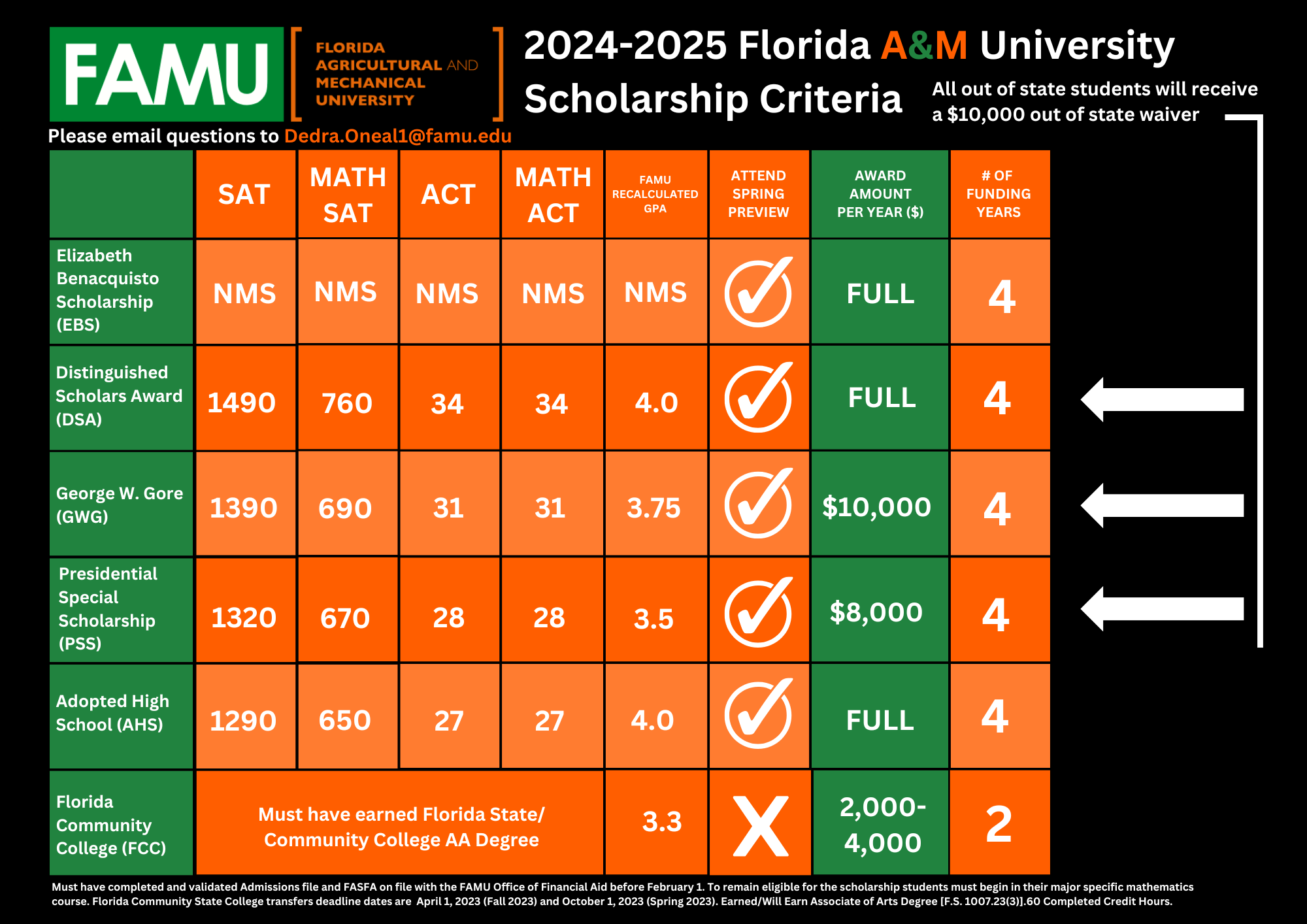

Scholarship Opportunities

How to Get a Full Ride Scholarship (2025 Guide)

Full Ride USA Scholarship 2024 Fully Funded

FullRide Scholarships to Study in the USA Scholarship

Scholarships FAMU NAA MiamiDade Chapter

The FullRide Scholarship eBook Over 100 Scholarships Included

A Guide to FullRide Scholarships + a list of 124 scholarships

Or Do You Need To Ring Up ?

This Number Appears Invalid On The Vies Search.

For The Uk You Can Ring The Hmrc Helpline (Vat Helpline:

Will This Have Any Tax/Vat.

Related Post: