Expenses And Scholarships Form 1098 T

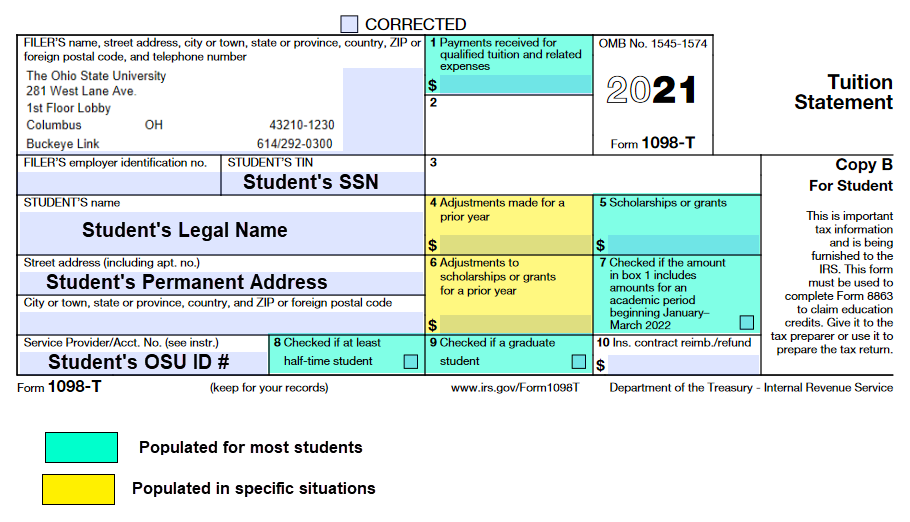

Expenses And Scholarships Form 1098 T - As a gst/hst registrant, you recover the gst/hst paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. Your financial toolkit is currently offline you can explore other financial literacy resources at canada.ca/money or access helpful financial tools at fcac’s financial tools and. A qualifying expenditure is all of the following: Go to home office expenses for employees for more information. Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. However, an increase in a property's market. Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit. The excessive interest and financing expenses limitation (eifel) rules limit the deductibility of net interest and financing expenses by certain corporations and trusts. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. Go to home office expenses for employees for more information. The excessive interest and financing expenses limitation (eifel) rules limit the deductibility of net interest and financing expenses by certain corporations and trusts. You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses. A qualifying expenditure is all of the following: Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. As a gst/hst registrant, you recover the gst/hst paid or payable on your purchases and expenses related to your commercial activities by claiming input tax credits. However, an increase in a property's market. Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses. Your financial toolkit is currently offline you can explore other financial literacy. A qualifying expenditure is all of the following: Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Go to home office expenses for employees for more information. However, an increase in a property's market. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. The excessive interest and financing expenses limitation (eifel) rules limit the deductibility of net interest and financing. Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Your financial toolkit is currently offline you can explore other financial literacy resources at canada.ca/money or access helpful financial tools at fcac’s financial tools and. A reasonable expense that is. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. As a gst/hst registrant, you recover the gst/hst paid or payable. A qualifying expenditure is all of the following: You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses. Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. However, an increase in a property's market. A reasonable expense that. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. The excessive interest and financing expenses limitation (eifel) rules limit the deductibility of net interest and financing expenses by certain corporations and trusts. A qualifying expenditure is all of the following: Individuals with a severe and prolonged impairment in physical or mental functions can use this. You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. As a gst/hst registrant, you recover the gst/hst paid or payable on. A qualifying expenditure is all of the following: A reasonable expense that is. Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Go to home office expenses for employees for more information. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. However, an increase in a property's market. Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. A qualifying expenditure is all of the following: Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. Your financial toolkit is currently offline you can explore other financial literacy resources at canada.ca/money or access helpful financial tools at fcac’s financial tools and. Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Expenses. A qualifying expenditure is all of the following: Renovations and expenses that extend the useful life of your property or improve it beyond its original condition are usually capital expenses. Living expenses for yourself and the family members who come with you while you’re in canada transportation to and from canada for yourself and your accompanying family members how. The excessive interest and financing expenses limitation (eifel) rules limit the deductibility of net interest and financing expenses by certain corporations and trusts. However, an increase in a property's market. Your financial toolkit is currently offline you can explore other financial literacy resources at canada.ca/money or access helpful financial tools at fcac’s financial tools and. Expenses, expenditure, spending 都可翻译为支出的意思,但是其含义实际用途不同, expenses是指开销,花费。比如说你在国外用来住宿的开销有多大。这里就用expense. Individuals with a severe and prolonged impairment in physical or mental functions can use this form to apply for the disability tax credit. Expenses that qualify the renovation expenses that you can claim must be qualifying expenditures. You may be eligible to claim a deduction for employment expenses if you incurred any of the following expenses.Understanding your IRS Form 1098T Student Billing

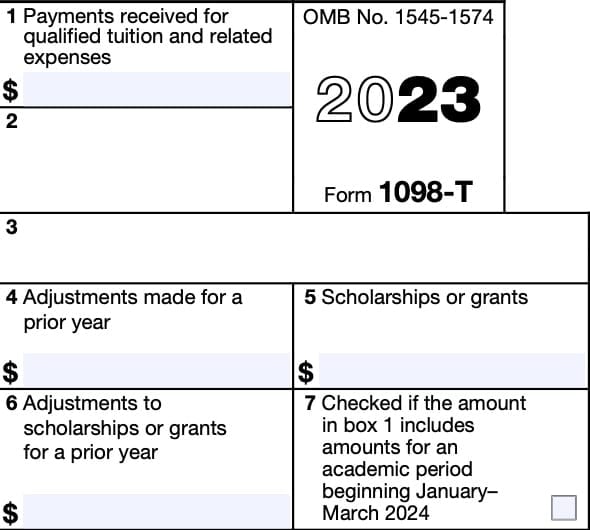

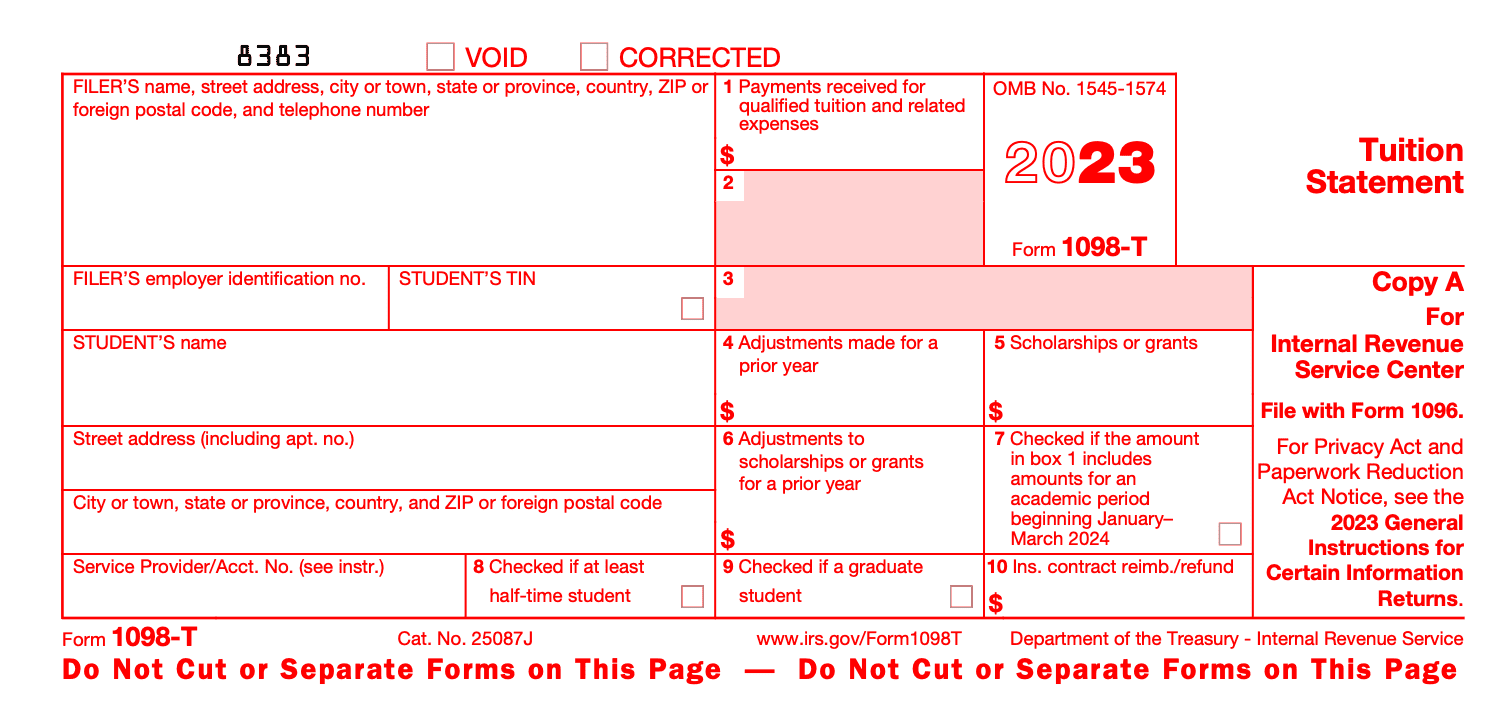

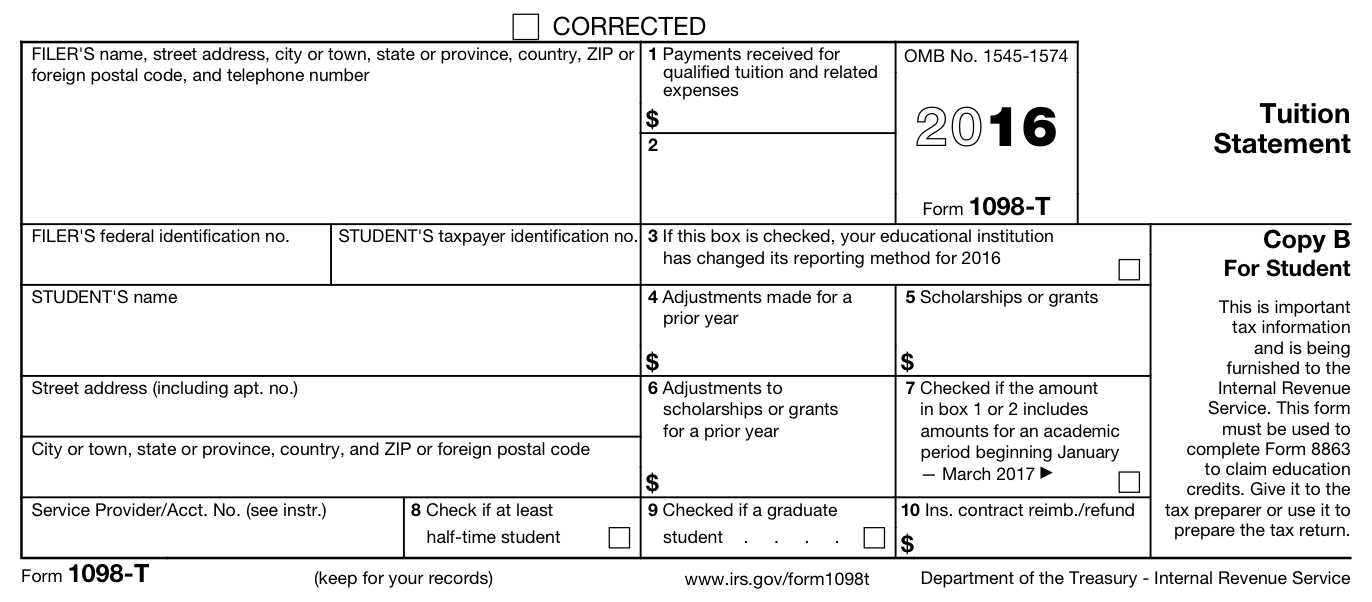

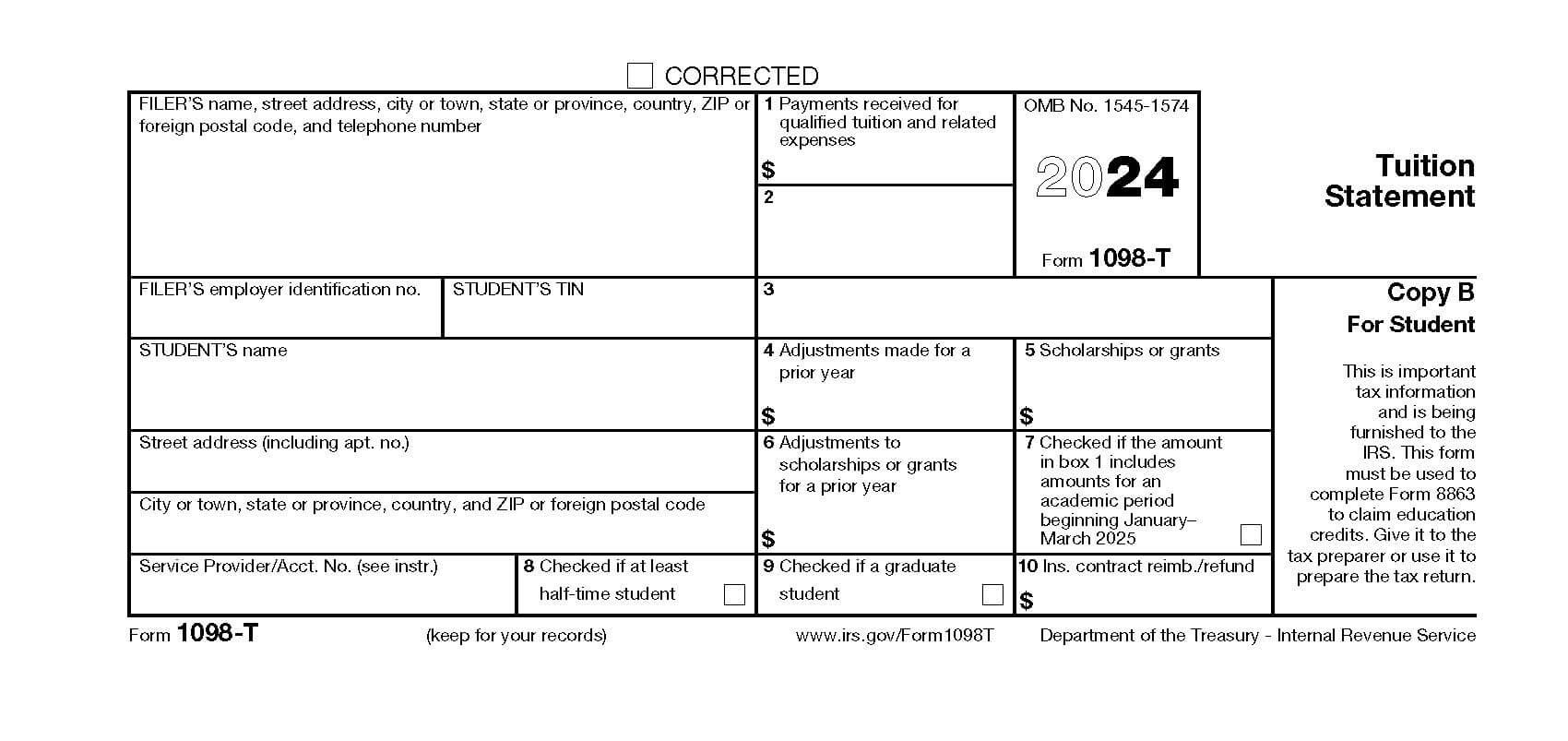

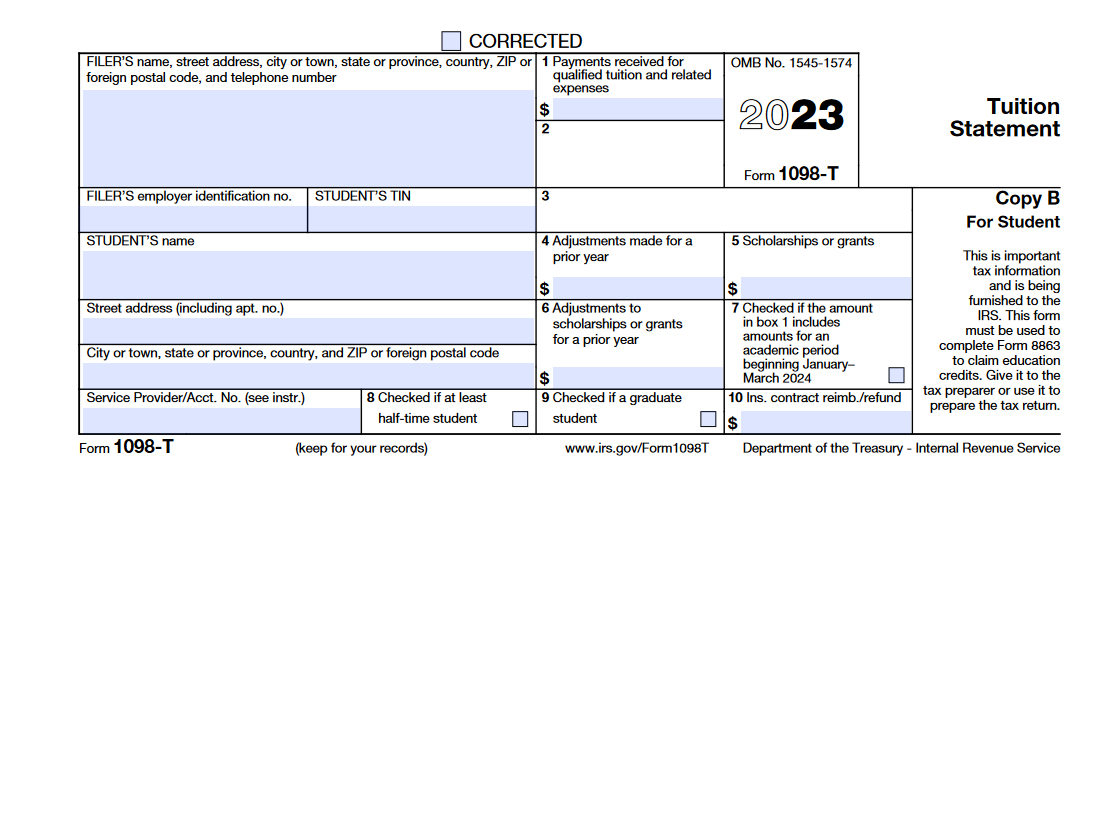

IRS Form 1098T Instructions Tuition Statement

Complete Guide to Form 1098T Claim Education Tax Benefits

Printable 1098 T Tax Form Printable Forms Free Online

1098T Form How to Complete and File Your Tuition Statement

Form 1098T YouTube

IRS Form 1098T What College Students Should Know

IRS Approved 1098T Copy B Tax Form Bulk 500 Sheets

Tax Information 1098T Office of Business and Finance

IRS Form 1098T. Tuition Statement Forms Docs 2023

As A Gst/Hst Registrant, You Recover The Gst/Hst Paid Or Payable On Your Purchases And Expenses Related To Your Commercial Activities By Claiming Input Tax Credits.

Go To Home Office Expenses For Employees For More Information.

A Reasonable Expense That Is.

Related Post: