501C3 Scholarship Rules Irs

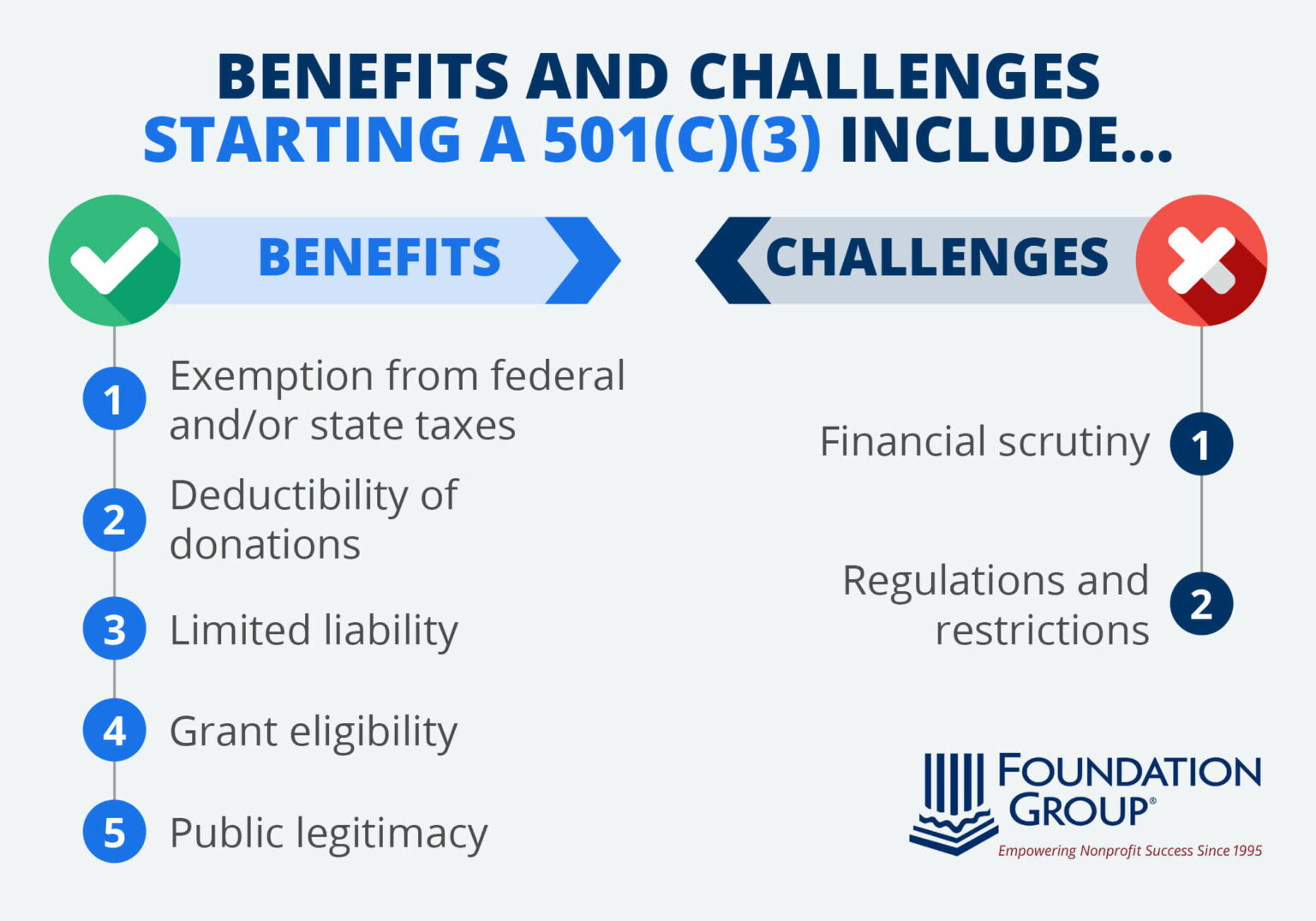

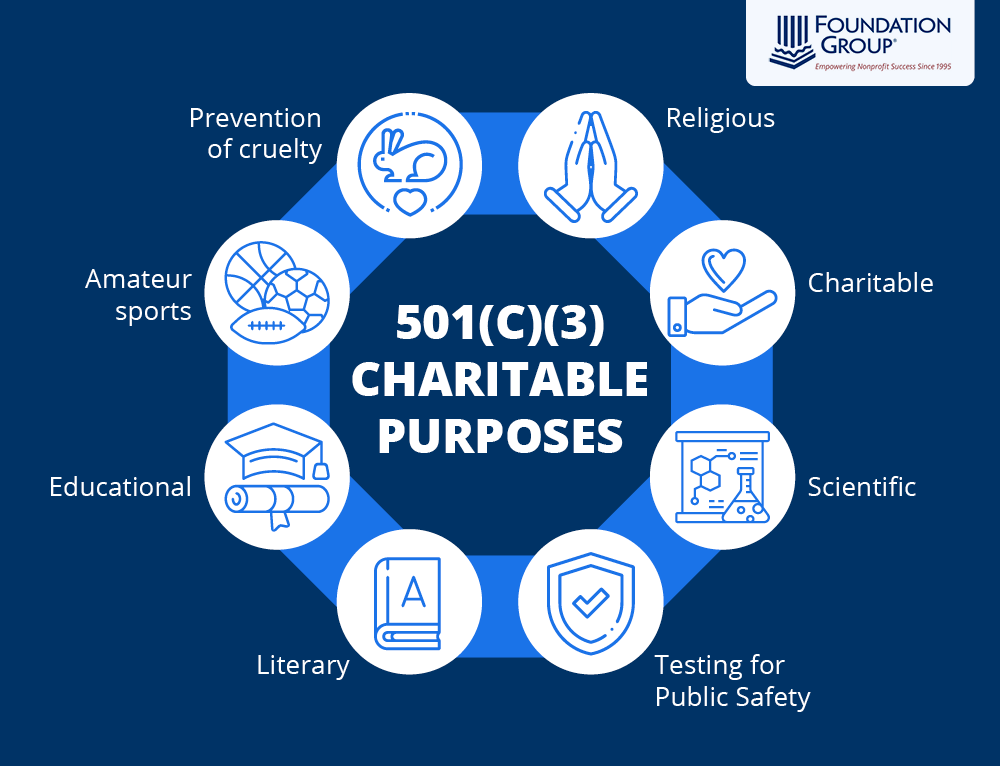

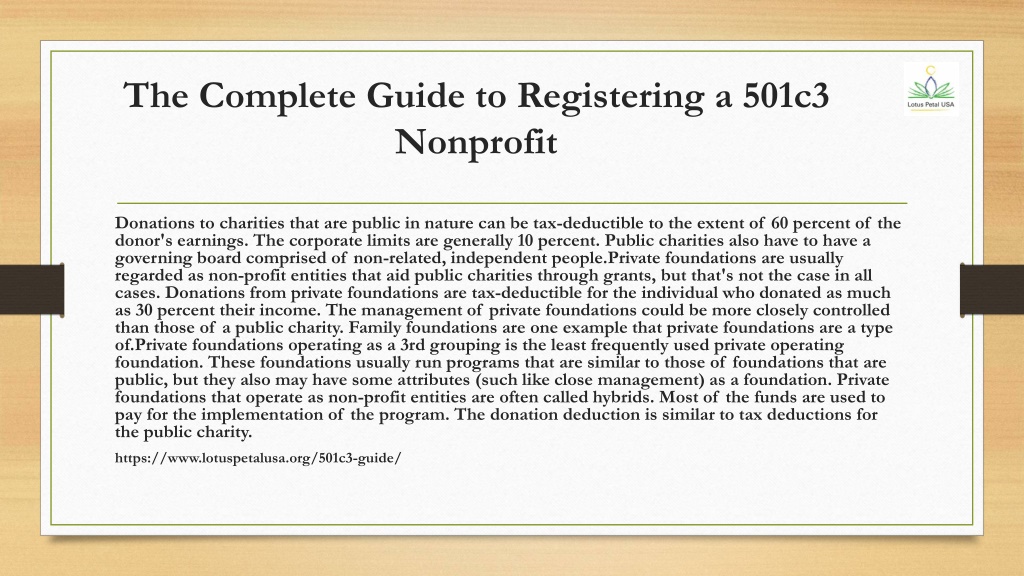

501C3 Scholarship Rules Irs - Learn the requirements and costs of setting up a 501(c)(3). Many people use these terms interchangeably: 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. What is a 501 (c) (3) nonprofit organization? The name comes from section 501 (c) (3) of the. In reality, an organization could be one of those, all of those, or somewhere in. Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Nonprofit, charity, exempt organization, and 501 (c) (3). Eine 501 (c) organization (kurz: Nonprofit, charity, exempt organization, and 501 (c) (3). The name comes from section 501 (c) (3) of the. In reality, an organization could be one of those, all of those, or somewhere in. Many people use these terms interchangeably: A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Eine 501 (c) organization (kurz: Unsure if your nonprofit qualifies for 501(c)(3) status? Learn the requirements and costs of setting up a 501(c)(3). Nonprofit, charity, exempt organization, and 501 (c) (3). Eine 501 (c) organization (kurz: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. Many people use these terms interchangeably: Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. In reality, an organization could be one of those, all of those, or somewhere in. Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the. Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. What is a 501 (c) (3) nonprofit organization? Eine 501 (c) organization (kurz: Nonprofit, charity, exempt organization, and 501 (c) (3). The name comes from section 501 (c) (3) of the. Unsure if your nonprofit qualifies for 501(c)(3) status? Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. A 501 (c). Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the. Nonprofit, charity, exempt organization, and 501 (c) (3). In reality, an organization could be one of those, all of those, or somewhere in. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt. Unsure if your nonprofit qualifies for 501(c)(3) status? A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. The name comes from section 501 (c) (3) of the. What is a 501 (c) (3) nonprofit organization? Nonprofit, charity, exempt organization, and 501 (c) (3). Learn the requirements and costs of setting up a 501(c)(3). Unsure if your nonprofit qualifies for 501(c)(3) status? Many people use these terms interchangeably: A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. In reality, an organization could. Eine 501 (c) organization (kurz: A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Learn the requirements and costs of setting up a 501(c)(3). A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3). Nonprofit, charity, exempt organization, and 501 (c) (3). A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. What is a 501 (c) (3) nonprofit organization? A 501 (c) (3) nonprofit organization is generally a business entity that adds. A 501 (c) (3) organization is a united states corporation, trust, unincorporated association, or other type of organization exempt from federal income tax under section 501 (c) (3) of title 26. The name comes from section 501 (c) (3) of the. Learn the requirements and costs of setting up a 501(c)(3). Nonprofit, charity, exempt organization, and 501 (c) (3). Eine. 501 (c)) ist eine gemeinnützige organisation, nach dem bundesrecht der vereinigten staaten in übereinstimmung mit dem internal revenue code (26. A 501 (c) (3) nonprofit organization is generally a business entity that adds to the public good. Learn the requirements and costs of setting up a 501(c)(3). Eine 501 (c) organization (kurz: In reality, an organization could be one of those, all of those, or somewhere in. Nonprofit, charity, exempt organization, and 501 (c) (3). Unsure if your nonprofit qualifies for 501(c)(3) status? The name comes from section 501 (c) (3) of the.IRS 501c3 Applications, Start a Nonprofit Incorporation Services, 501c3

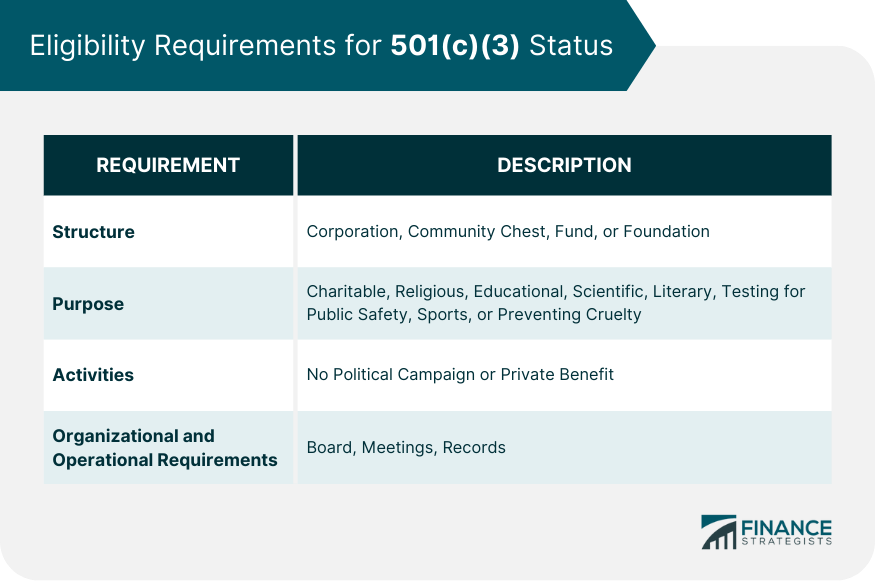

IRS Rules for 501(c)(3) Coverage, Compliance, Consequences

How to Start a 501(c)(3) Steps, Benefits, and FAQs

501c3.guidelines Issued by The IRS PDF Irs Tax Forms 501(C

What is a 501(c)(3)? A Guide to Nonprofit TaxExempt Status

PPT 501c3 PowerPoint Presentation, free download ID12023918

IRS 501(c)(3) Application Definition, Requirements, and Process

501(c)(3) Organization AwesomeFinTech Blog

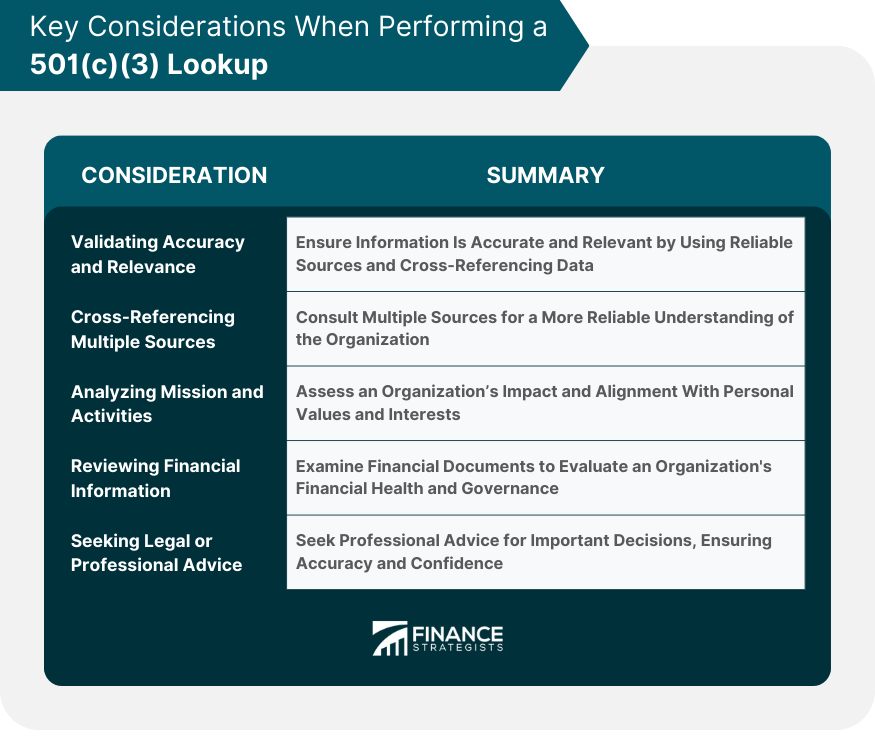

How to Perform a 501(c)(3) Lookup Purpose, Methods, Benefits

501(c)(3) Status Meaning, Purpose, Pros, Cons, How to Apply

Many People Use These Terms Interchangeably:

What Is A 501 (C) (3) Nonprofit Organization?

A 501 (C) (3) Organization Is A United States Corporation, Trust, Unincorporated Association, Or Other Type Of Organization Exempt From Federal Income Tax Under Section 501 (C) (3) Of Title 26.

Related Post: